From Advice to Algorithms: Implementing Fintech Solutions in Financial Consulting

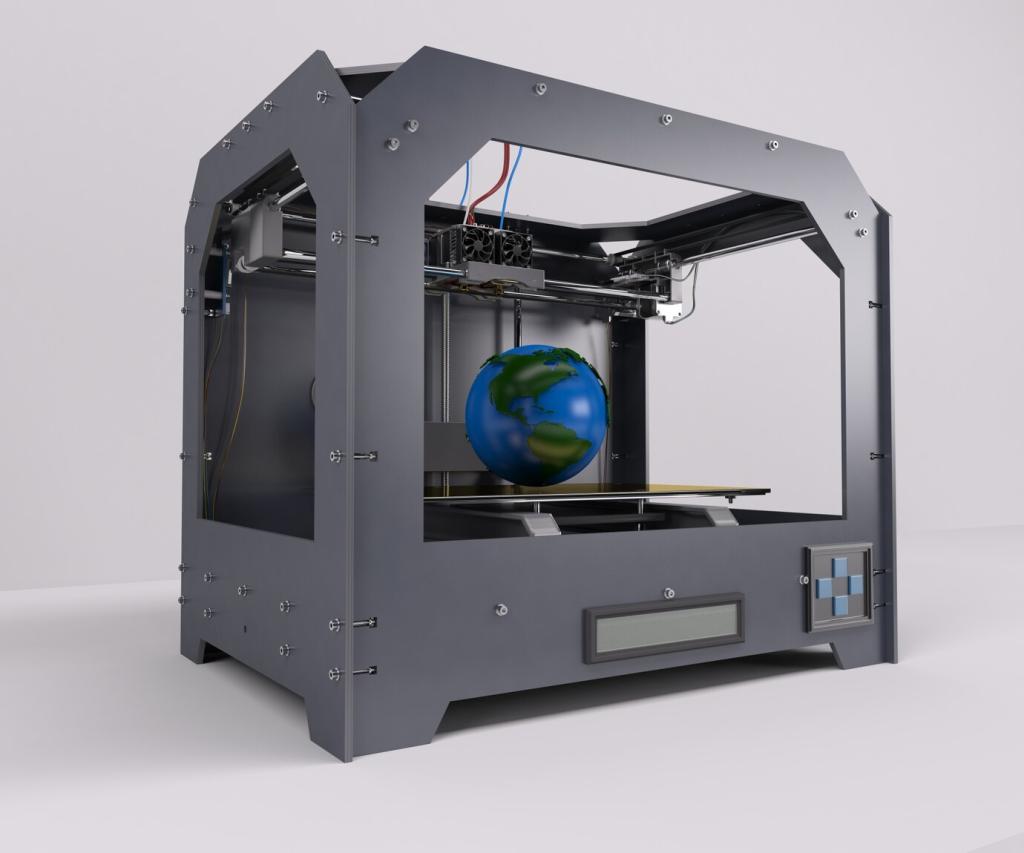

Chosen Theme: Implementing Fintech Solutions in Financial Consulting. Step into a future where insight meets innovation—where advisors harness APIs, analytics, and automation to deliver sharper strategies, faster execution, and truly client-centric value. Join us, share your perspective, and subscribe for hands-on guides and real-world stories.

Map Outcomes to Capabilities

Link every desired outcome—faster onboarding, richer insights, tighter compliance—to a specific fintech capability, avoiding shiny-object syndrome. This alignment keeps projects focused, budgets honest, and teams coordinated when inevitable trade-offs appear under real-world constraints and changing client expectations.

Anecdote: The Mid-Market Firm That Simplified to Win

One advisory team tried ten tools at once and stalled. They refocused on one pain point—rebalancing time—and implemented a single automation module. Client meetings doubled, satisfaction rose, and momentum attracted broader buy-in across skeptical partners who finally saw tangible results.

Phase the Roadmap for Proof, Not Perfection

Design a phased plan that ships a tiny, testable slice within weeks. Early wins validate assumptions, reveal process gaps, and build trust. Tight feedback loops let you abandon weak bets quickly and double down on high-impact features clients immediately value.

Data, Compliance, and Trust by Design

Use risk-based workflows that escalate edge cases to analysts while automating routine checks. Combine identity verification, sanctions screening, and transaction monitoring with clear exception paths. Document decisions so regulators and clients understand not only what you decided, but why it was reasonable.

Data, Compliance, and Trust by Design

Implement explicit consent, granular data scopes, and easy revocation. Show clients what’s collected, where it flows, and how long it persists. Transparent dashboards transform privacy from legalese into a service feature that differentiates and strengthens long-term advisory relationships.

Integration Architecture: API-First and Secure

Adopt RESTful APIs with consistent pagination, idempotency, and versioning. Use webhook callbacks or event streams for timely updates. Keep orchestration lightweight so components can be swapped without breaking core advisory workflows or compromising client data integrity during peak periods.

Integration Architecture: API-First and Secure

Implement OAuth 2.0 and short-lived tokens. Enforce least privilege with role-based and attribute-based controls. Segment networks, rotate secrets, and verify every request. Zero trust reduces blast radius when credentials leak, and auditors respect the discipline during rigorous security reviews.

Client Experience: Personalization that Earns Loyalty

Replace repetitive forms with progressive disclosure, prefill verified data, and provide live status tracking. A boutique firm we coached cut onboarding from weeks to days, and clients praised the clarity, saying it felt like concierge service rather than paperwork purgatory and uncertainty.

Risk Management and Cyber Resilience

Threat Modeling with Third-Party Visibility

Map data flows across every vendor connection. Identify entry points, sensitive stores, and high-value transactions. Prioritize controls where exposure concentrates. Continuous scanning and vendor risk reviews close the gaps that enthusiastic pilots often open in complex integration landscapes.

Encryption, Keys, and Secrets Hygiene

Use strong encryption at rest and in transit, dedicated key management, and automated rotation. Guardrails for secrets in code repos prevent accidental leaks. Small operational disciplines here avert headlines, regulatory penalties, and costly client churn following avoidable security incidents.

Resilience: Backups, Runbooks, and Drills

Test restore times, simulate provider outages, and document fallback procedures clients can understand. When an outage occurs, transparent updates and practiced recovery turn a stressful moment into a trust-building demonstration of preparedness, competence, and genuine client care.

Measure ROI and Iterate with Evidence

Build a KPI Tree That Guides Decisions

Connect revenue, retention, and cost-to-serve to actionable levers like onboarding time, advisor capacity, and data freshness. Visibility aligns teams, clarifies trade-offs, and stops debates anchored in opinion instead of client impact and measurable business value creation.

Experimentation as a Habit

Run A/B tests on outreach timing, portfolio nudges, or report formats. Celebrate learning, not just wins. Over time, small empirical improvements compound into a service that feels consistently sharper, more responsive, and unmistakably tailored to each client’s goals.

Close the Loop with Clients

Invite clients to quarterly feedback sessions. Share what you changed because of their input. When clients see their voice shaping your fintech roadmap, loyalty rises and referrals follow because collaboration feels real, not performative or merely procedural.